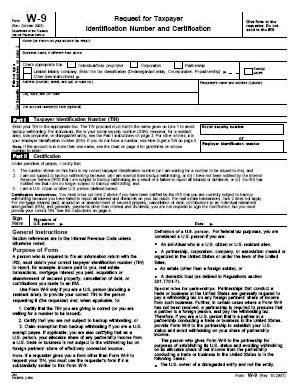

Download an IRS W-9 FormA taxpayer's "ID Number Request Form" The W9 or W-9 form is a "Request for Taxpayer Identification Number and Certification". This is what a company or a person will fill out to provide official identification to someone who will pay them money for work or interest or any income as a self employed individual as well as for a few other situations. The form also asks for your form of ID whether is your Social Security number or your Employer ID number (EIN). If you do not have a social-security numer and you are a non-resident alien then you should put in your TIN number. It is usually a very simple form to fill out. Here are the W9 instructions for the requester of the form. These folks would fill out a W9 form.

Back-up WithholdingIn some situations the IRS will notify you that you will be subject to backup withholding. This is not very common and most of us will never know about this but it does occur. Who gets the form?The person who asked you for it will be the person that you submit the completed form to. Not the IRS. Do not sent it to the IRS as they have no interest in using the form. It is information for the payer. They need your information for the time when they file taxes to sent the IRS and you the information on your earnings. They send you a 1099 form showing how much money you earned from them in the year. This should be sent to you by the end of January of the following year. I have gotten 1099 forms in February and a few in March over the years. |

That W9 form by the way is for things that are not covered on a W-2 form. The W9 covers such things as interest, money paid for work as an individual or sole proprietor, money from real-estate transactions, cancellation of debt, money contributed to an IRS etc. The first page is where you fill in your information and sign the form. There are 3 more pages of instructions so that you can be clear about the details. |

| For those who are not residents of the USA you should use the IRS Form W-8 Instructions and W8-BEN. |

For good tax information and printable forms, we also recommend www.TaxMan123.com.

For good W9 information we suggest www.PrintW9.com.

|

Roger Chartier